From Kalavinka Viewpoint #8

The prevailing mood now in Europe is to view China through a security and human rights lens rather than the trade and investment approach of the past 20 years. This has been heavily influenced by the policy of successive US administrations. People make a big mistake thinking geopolitical American policy always changes with a new administration. Not having Trump tweeting at 6am is a relief, but Joe Biden is going to be as hardline over security issues and relations with China as his predecessor. For better or worse in the UK, and to a lesser extent across the EU, having diverged for a decade, driven by the prospect of more limited access to intelligence ties, we have now decided to align ourselves more closely with US policy towards China. The UK’s recent National Security and Investment Act which identifies 17 sensitive sectors, including AI and quantum computing technologies where government can block investment transactions is a close imitation of CFIUS. So, for UK corporate investors in particular there is a new tension between investment and national security. With the new legislation and dynamics around trade, businesses will have to be politically advertent. They will have to look at whether the sector they seek investment in or to invest in in partnership with overseas investors is potentially sensitive.

Globally repatriation of supply chains will become an issue. These things ebb and flow. Over the 20th century, they expanded, shrank and expanded again. But, especially as a result of Brexit, the pandemic and people’s understanding of how the vaccinations were manufactured – and as a result of our new, much poorer relationship with China – repatriation is going to be an imperative. Going forward the best way of engaging with China and Chinese investment will be to avoid sourcing from sensitive provinces, not dealing with issues that could give rise to the sort of national infrastructure security concerns that Huawei did, and engaging positively over the essential global areas for cooperation such as the UN sustainable development goals and climate change. If we don’t, we won’t see net zero by 2050. China isn’t going to disappear as an important economic powerhouse and trading and investment partner. But we need to pick and choose where we trade and cooperate. And in this climate that will require good navigation skills.

6th April 2021

Regulating the Internet

6th April 2021

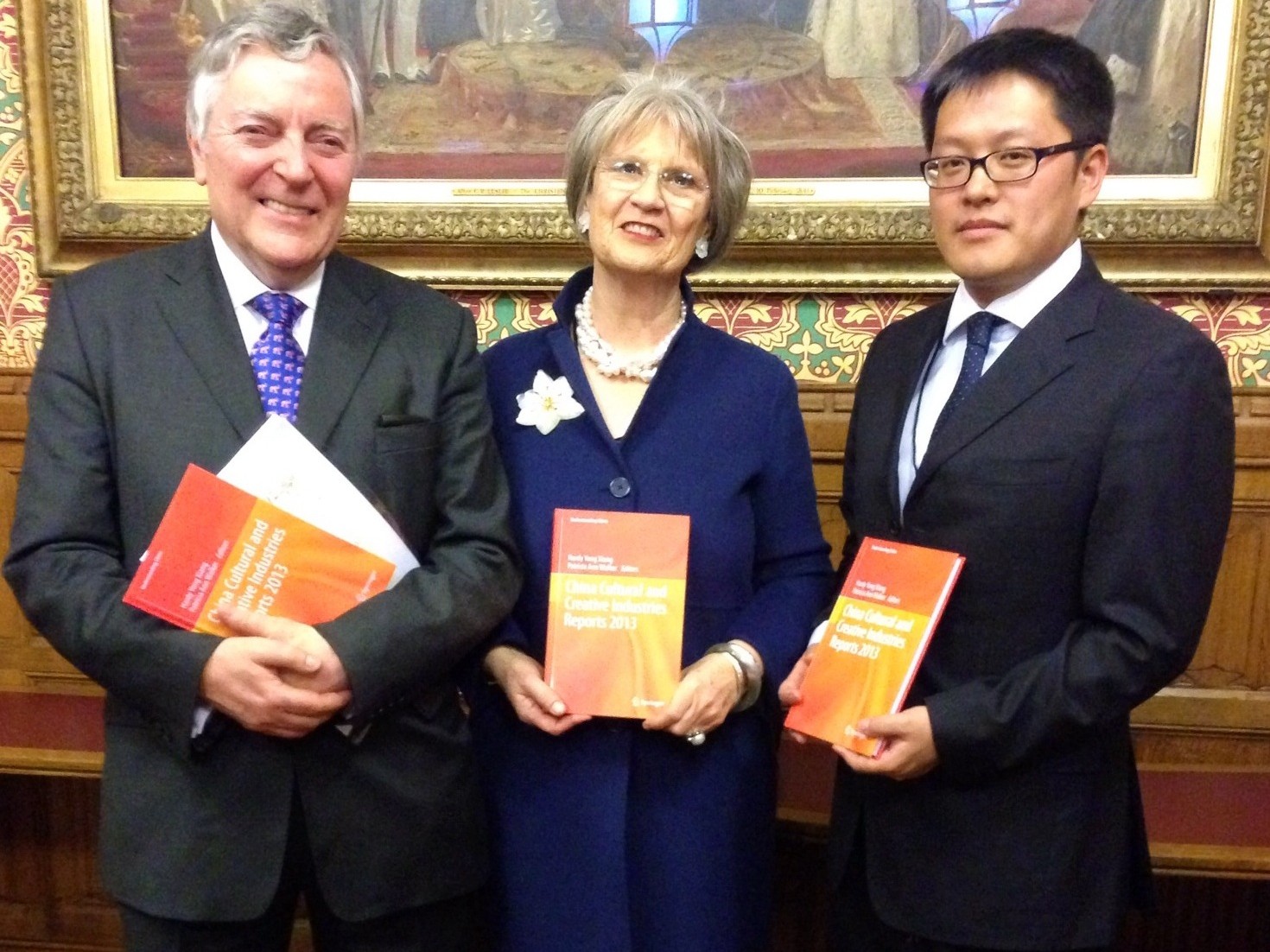

What will the year of the Ox bring in UK China Relations

15th December 2014